Amidst the continuous upgrading of global manufacturing and the booming home furnishing industry, edge banding machines, as core equipment in the board processing process, are playing an increasingly crucial role. They not only impact product quality and appearance, but also play a vital role in driving technological innovation and market expansion.

- Working Principle and Functional Demonstration

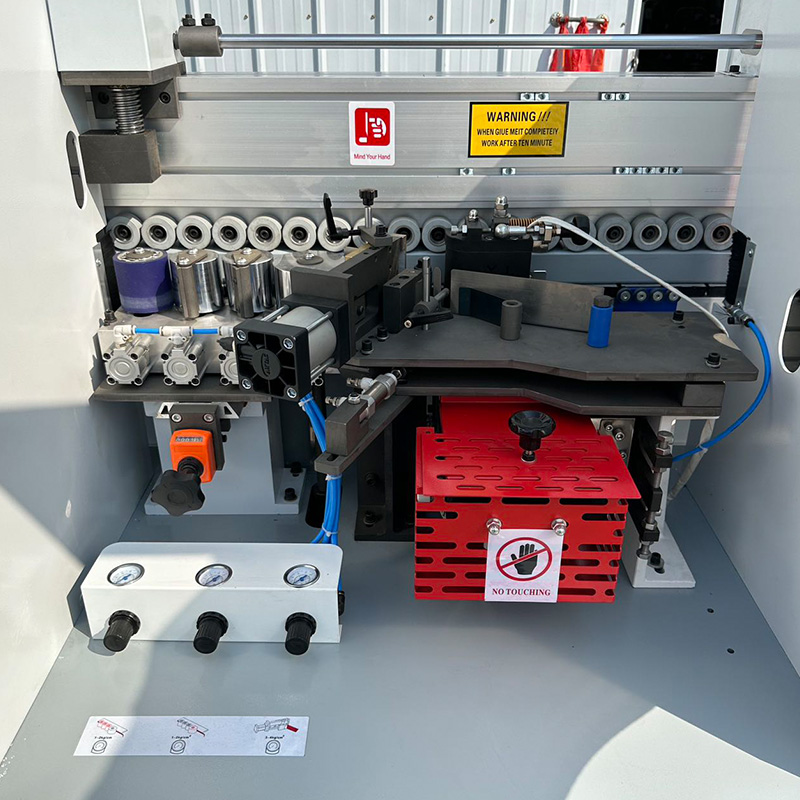

Edge banding machines are automated woodworking machinery used for board edge banding. They transform the traditional manual edge banding process, including conveying, gluing, trimming, cutting, front and back trimming, top and bottom trimming, top and bottom scraping, and polishing, into highly automated operations. For example, a typical linear edge banding machine uses a precise conveyor system to the gluing unit, where a gluing roller evenly applies hot-melt adhesive to the edge of the board. The edge banding tape is then quickly applied to the glued edge of the board, with a clamping mechanism ensuring a tight bond. Subsequently, the trimming unit uses precision linear guides and a high-speed cutting motor to remove excess front and back edges of the edge banding tape, resulting in a smooth, even cut surface. The finishing device uses automatic tracking technology to trim excess material from the edge banding, ensuring a smooth and even surface on both sides of the trimmed board. The scraping device further eliminates ripples left during the finishing process, resulting in a cleaner edge. Finally, the polishing device uses a cotton polishing wheel to polish the edge banding, creating a smooth and shiny finish. Some advanced edge banding machines are also equipped with a notching function, allowing them to directly notch wardrobe side and bottom panels, significantly reducing the need for saws and improving production efficiency.

- Significant Market Growth

In recent years, the edge banding machine market has shown a steady upward trend. Relevant data forecasts indicate that by 2025, the market size of my country’s edge banding machine industry is expected to exceed 10 billion yuan, with an average annual growth rate of 7%-9%. The global edge banding machine market reached $1.23 billion in 2024. According to the “2025-2030 Global and China Edge Banding Machine Industry Market Status Research and Development Prospects Analysis Report,” the market is projected to reach $1.64 billion in 2031, with a compound annual growth rate of 4.2% from 2025 to 2031. This growth trend is driven by multiple powerful forces.

The rapid development of the custom furniture market has become a key driver of edge banding machine market growth. With rising consumer demand for personalized home furnishings, the custom furniture market is expanding rapidly. By 2023, the custom furniture market is projected to exceed 620 billion yuan, directly driving increased demand for edge banding equipment. Custom furniture production places higher demands on the precision, quality, and efficiency of panel edge banding, prompting furniture manufacturers to continuously update and upgrade their edge banding equipment. Active policy guidance has also injected strong momentum into the growth of the edge banding machine market. The Ministry of Housing and Urban-Rural Development’s “Action Plan for High-Quality Development of the Green Building Materials Industry” explicitly mandates that the furniture industry’s automated equipment coverage rate increase to 65% by 2025. This policy direction has accelerated the equipment replacement cycle. To comply with this policy requirement and enhance their competitiveness, many furniture manufacturers have been forced to increase their investment in advanced edge banding equipment.

- Technological Innovation Leads Development

Intelligence has become a core trend in edge banding technology development. By 2023, the market penetration rate of intelligent edge banding machines is expected to increase from 28% in 2022 to 41%. Major manufacturers such as Nanxing Equipment and Hongya CNC have launched fully automatic models integrating visual recognition, automatic belt changing, and online inspection. These intelligent edge banding machines utilize advanced sensors and control systems to monitor various parameters during the edge banding process, such as glue temperature, pressure, and edge banding speed, in real time, and automatically adjust according to pre-set procedures to ensure stable and consistent edge banding quality. Laser edge banding technology, a cutting-edge technology in the field, has achieved significant breakthroughs in recent years. By 2023, laser edge banding technology will be domestically produced. Room-temperature laser adhesive films developed by local companies will reduce equipment energy consumption by 28%. This technology product line is expected to contribute 12% of industry revenue in 2024. Laser edge banding utilizes the high energy density of lasers to instantly melt and fuse the edge banding material with the board edge, creating a seamless, aesthetically pleasing, and durable edge band. Amidst growing environmental awareness and increasingly stringent environmental policies, green development has become an inevitable trend in the edge banding machine industry. The Ministry of Environmental Protection’s 2023 revision of the “Volatile Organic Compounds Control Plan” imposes stricter requirements on VOC emissions from edge banding adhesives, prompting 83% of large-scale enterprises to upgrade their exhaust gas treatment systems. Furthermore, the “Energy Efficiency Limits for Woodworking Machinery,” which will be implemented in 2024, will eliminate 15% of high-energy-consuming equipment.

- Regional Market Development

East China, centered in Shanghai and Suzhou, holds a leading position in the edge banding machine market thanks to its advanced intelligent manufacturing upgrades and strong economic strength. In 2023, procurement of automated edgebanding equipment in the region increased by 22% year-on-year, and the market penetration rate of industrial robot-integrated edgebanding workstations exceeded 17%. Numerous large furniture manufacturers and high-end custom home brands are concentrated in this region, generating strong demand for high-quality, high-performance edgebanding equipment. With the advancement of national industrial transfer policies and the rapid economic development of the central and western regions, the region demonstrates enormous development potential in the edgebanding machine market. In 2023, demand for technological transformation in Northeast China’s old industrial bases was unleashed, and the used equipment refurbishment market exceeded 280 million yuan, accounting for 26% of the national stock market transactions. Furthermore, the Chengdu-Chongqing Economic Circle included woodworking machinery as a key supported industry, and edgebanding production in both regions increased by 29% year-on-year in 2023. Policy differences across regions have had a profound impact on the development of the edgebanding machine market. Guangdong Province’s “Ten Measures for Advanced Manufacturing Investment,” issued in 2023, provides a 15% subsidy for technological transformation projects involving intelligent edgebanding equipment, prompting 80% of enterprises in the region to initiate digital transformation, significantly boosting the development of the edgebanding machine market in Guangdong Province. Edge banding equipment plays a pivotal role in the panel processing industry. Looking ahead, driven by technological innovation, the edge banding market will continue to expand its application areas, improve product quality and performance, and inject new vitality into the development of the global manufacturing and home furnishing industries.