The acquisition battle involving Stratasys is indeed a hot topic in the global 3D printing industry. Some investors see it as a positive development, bringing much-needed excitement to the industry. However, if we look beyond the surface, a recent article by Forbes magazine sheds light on the significant implications behind this struggle¡ªit's essentially a battle within the manufacturing sector.

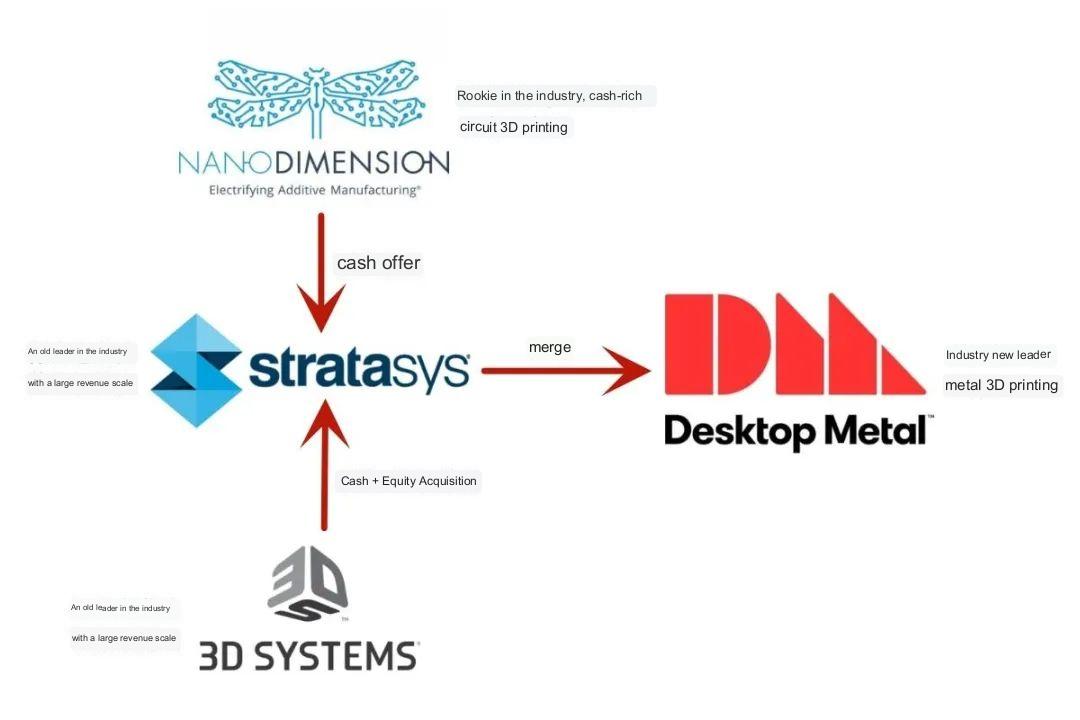

The 3D printing industry is currently experiencing significant turbulence, manifested in the scramble for valuable companies within the industry. When the electronic circuit 3D printer manufacturer Nano Dimension announced its plans to acquire the 3D printer manufacturer Stratasys, chaos ensued. Multiple companies began vying for acquisitions or mergers with Stratasys.

Stratasys is one of the two publicly traded giants in the 3D printing industry, the other being 3D Systems. It boasts the highest revenue among all pure-play 3D printing companies, with $651.5 million in revenue in 2022, and holds the largest market share in the 3D printing industry. It's not surprising that both Desktop Metal, as well as 3D Systems and Nano Dimension (an Israeli electronic 3D printer manufacturer), expressed interest in Stratasys and sought potential mergers.

Regardless of what unfolds with Stratasys, it has already proven to be a crucial player in the 3D printing and manufacturing industry. The parties involved in the acquisition struggle are facing lawsuits and encountering active investors and other obstacles that are slowing down any potential mergers. Let's take a look at the participants in this acquisition battle.

Nano Dimension: The small player with deep pockets

The origins of the Stratasys acquisition battle can be traced back to Nano Dimension. This Israeli company may be small in name and stature, but after eight public offerings of common stock, it has amassed over $1 billion in cash¡ªa massive war chest for a company with only $70 million in annual revenue. However, when its largest institutional investor, Cathie Wood's ARK Investment Management, exited, a relatively unknown Canadian investor, Murchinson, stepped in, acquiring approximately 4% of Nano Dimension's shares and immediately causing trouble.

After Nano's board rejected Murchinson's takeover bid, the aggressive investor attempted to oust the management through shareholder action, leading to a legal battle in court. Murchinson's acquisition move prompted Nano to initiate a hostile takeover of Stratasys, seeking to fulfill its commitment to shareholders.

With its substantial cash reserves, Nano Dimension acquired over 14% of Stratasys' stock, prompting the latter to implement a so-called "poison pill" defense mechanism to prevent further stock purchases. Subsequently, Stratasys rejected several proposals from Nano for a cash acquisition worth over $1 billion. This hasn't deterred the small company from directly approaching Stratasys' wide range of shareholders, attempting to gain majority control over this cornerstone 3D printing company.

Desktop Metal: The initiator of the mergers

In reality, merger negotiations between Stratasys and Desktop Metal have been ongoing for two years, but Nano's aggressive strategy seems to have prompted both companies to publicly announce their intentions since the merger would dilute Nano's overall ownership. Although Desktop Metal has developed innovative metal 3D printing technologies with support from Google, BMW, and Stratasys itself, it seemed to have become a tool for acquisitions to some extent after its IPO in December 2020. Utilizing the cash obtained from its IPO, Desktop Metal first acquired a long-established plastic 3D printing company, EnvisionTEC, and then acquired ExOne, a company developing binder jetting metal printing technology.

Through the combination with Desktop Metal, Stratasys will finally be able to incorporate metal 3D printing into its product portfolio. In many ways, this combined entity will become the most dominant force in the 3D printing industry, posing a greater threat to another stalwart of 3D printing, 3D Systems.

3D Systems: The veteran

3D Systems gained acclaim for filing the first patent for 3D printing technology in 1986. It possesses a wide range of technologies and materials, including different types of plastic and metal printing systems. In recent years, it witnessed Stratasys adding various directly competitive products to its product lineup but hadn't made inroads into the metal 3D printing domain. The merger proposal from Desktop Metal seemed to be the final straw, as just a few days after the announcement of the transaction, 3D Systems made its own offer to acquire Stratasys, with stock, cash, and 40% ownership in the merged entity.

The players behind the acquisition battle

This drama involves some complex background characters. Murchinson, led by the son of a New York real estate billionaire, was fined $8.15 million by the U.S. Securities and Exchange Commission for alleged problematically short-selling. The proactive investor who took over Nano Dimension is also suspected of engaging in similar behavior.

Meanwhile, Goldman Sachs is advising 3D Systems on its proposal to Stratasys. According to a report, Goldman Sachs held a meeting with a company attempting to obstruct the Desktop Metal merger. This party is the Donerail Group, a relatively new financial management company whose only significant public activity has been actively acquiring a well-known gaming peripheral company, Turtle Beach.

Overall, the acquisition battle in the 3D printing industry reflects the intense competition within the manufacturing sector, with Stratasys at the center of it all.

Donerail, led by Chief Investment Officer William Wyatt, actually began his career at Goldman Sachs a decade ago, which suggests the possibility of taking active action against the Stratasys board.

Meanwhile, Desktop Metal strengthens itself in the merger deal by absorbing sympathetic investor Faharid "Fred" Ebrahimi, an Iranian-American tech billionaire. Additionally, in order to protect itself from hostile takeovers while attempting to merge with Stratasys, Desktop Metal implemented its own "poison pill" measure, leading to a lawsuit filed by one of its institutional investors, the Western Pennsylvania Teamsters and Employers Pension Fund.

Stratasys also faces a lawsuit from former shareholders of a startup it acquired, claiming that the company failed to fulfill the terms of the acquisition agreement. The lawsuit aims to ensure that regardless of how the merger proceeds and with whom, the former shareholders have the opportunity to obtain their full acquisition benefits through legal proceedings.

Recently, Stratasys allowed a vote to take place at a meeting in August, which would allow shareholders to vote on the possibility of replacing its entire board with the management team of Nano Dimension.

We still don't know what will happen next. Stratasys and Desktop Metal intend to join forces, while 3D Systems and Nano Dimension appear to be focused on taking over Stratasys.

The underlying purpose behind the acquisition battle

All these players may be vying for control of the relatively small 3D printing market, which is currently estimated to be worth around $13.5 billion. There's sufficient reason for the key players to compete for it, but the presence of external participants and larger manufacturing trends suggest larger interests at stake.

Currently, nations and companies globally are launching advanced manufacturing initiatives to achieve both supply chain resilience and carbon emissions reduction. Alongside robotics and artificial intelligence, 3D printing is at the core of this strategy as it can be used to produce critical items locally, improve energy efficiency, and reduce the carbon footprint of human activities, spanning from aircraft manufacturing to automotive construction.

Similar programs are being pursued in Canada, Australia, the UK, the EU, and China, with support from some of the world's largest companies such as Lockheed Martin and Siemens, targeting the integration of 3D printing into their production. The estimated value of the entire manufacturing industry is $13 trillion, and decarbonization and supply chain are avenues through which 3D printing aims to disrupt manufacturing. The development of Stratasys may be the first bullet fired in a larger battle to come.